Coca-Cola’s development potential – abstract

- Coca‑Cola delivered robust 2025 income however confronted strategic turbulence

- Costa Espresso underperformed and complex Coca‑Cola’s lengthy‑time period development plans

- Coca‑Cola’s evolving portfolio technique strengthened retail execution and class affect

- Rising wellness tendencies provide alternatives requiring sharper innovation and partnerships

- Purposeful drinks and sizzling drinks pose strategic challenges demanding centered choices

It’s been a turbulent 12 months for The Coca‑Cola Firm.

The beverage big delivered stable profitability, posting a internet earnings of $13bn (€11.2bn) for the twelve months ending 30 September 2025 (MacroTrends). That’s a 25% enhance on 2024, highlighting the model’s strong revenue momentum because it heads into 2026.

However this success was tempered by strategic missteps, because it did not develop its service sector enterprise, Costa Espresso.

Coca-Cola accomplished the £3.9bn buy of British espresso chain Costa Espresso again in January 2019. However cracks quickly started to indicate, with Coca-Cola chief govt James Quincey saying Costa had “not fairly delivered” and it was “not the place we wished it to be from an funding speculation viewpoint”.

Analysts nevertheless have been extra crucial of the multinational, with Nandini Roy Choudhury, principal advisor for meals and beverage at analytics group Future Market Insights, saying “Coca-Cola underestimated how capital-intensive and operationally demanding the café enterprise is, in comparison with Coca-Cola’s conventional focus and bottling mannequin.”

Now, efforts to dump the Costa have additionally apparently failed, with rumours the sale has been scrapped rife all through the business.

But, regardless of the turbulence of the previous 12 months, the corporate is proving it has what it takes to attain vital development in 2026.

The key to Coca-Cola’s success

If you wish to perceive why Coca‑Cola retains profitable, no less than within the retail sector, look no additional than its evolving playbook. The corporate isn’t simply reacting to alter, it’s actively reshaping its future.

“Coca-Cola’s adaptation technique is more and more portfolio-led moderately than brand-led,” says Future Market Insights’ Choudhury.

In contrast with friends like PepsiCo, which has leaned closely into useful vitamin and snacks, Coca-Cola has centered on broadening alternative inside drinks – spanning low- and no-sugar variants (Coca-Cola Zero Sugar), hydration (Smartwater), ready-to-drink tea (Fuze Tea), sports activities drinks (Powerade), and premium mixers (Schweppes).

“Its method prioritises reformulation, portion management, and selective premiumisation moderately than radical reinvention,” says Choudhury. “This has allowed Coca-Cola to guard core model fairness whereas steadily aligning with well being, moderation, and lifestyle-driven consumption.”

The all-American model’s success can be rooted in its capacity to execute with excessive self-discipline on the level of sale.

Retail patrons constantly reward the corporate’s class administration capabilities, from precision demand forecasting to its unmatched merchandising engine.

Whether or not it’s tailoring pack codecs for comfort channels, optimising shelf units for supermarkets, or leveraging data-led insights to anticipate seasonal shifts, Coca‑Cola’s retail partnerships are designed to develop your complete mushy drinks class moderately than merely chase share.

This collaborative, market‑shaping method has strengthened its affect with retailers whereas guaranteeing that innovation, nevertheless incremental, lands with most business impression.

Development potential

Wanting forward, Coca‑Cola has vital room to speed up development by leaning into the very tendencies reshaping the beverage panorama.

Rising demand for low‑sugar formulations, cleaner labels, and “on a regular basis premium” choices continues to create headroom for manufacturers like Smartwater and Schweppes.

However among the strongest future alternatives lie within the quick‑rising useful beverage area – from intestine‑well being drinks to adaptogenic blends and protein‑fortified codecs, the place specialist innovators comparable to Yakult, Vita Coco, and Celsius at present set the tempo.

With its unmatched scale, distribution, and advertising and marketing infrastructure, Coca‑Cola is properly positioned to broaden into these perform‑first classes, offered it pairs its present strengths with sharper, extra focused innovation.

Past product innovation, Coca‑Cola additionally has alternatives to drive development by deepening its cultural relevance.

And whereas shoppers aren’t explicitly on the lookout for “tech drinks”, they’re more and more drawn to digital‑first storytelling, restricted‑version releases, and experiences that really feel participatory and shareable, explains Future Market Insights’ Choudhury.

Challenger manufacturers have excelled right here, blurring the traces between beverage, tradition, and group. Coca‑Cola has made strides by way of collaborations, music and gaming tie‑ins, and digital‑led campaigns, however the larger alternative lies in scaling these cultural touchpoints right into a constant development engine.

Coca‑Cola’s development gaps

However even with its robust retail execution and broadening portfolio, Coca‑Cola nonetheless faces some structural challenges that would form its subsequent part of development.

“Conventional full-sugar carbonated mushy drinks face long-term quantity stress in lots of developed markets,” says Future Market Insights’ Choudhury.

And whereas Coca‑Cola Zero Sugar has helped cushion the blow, most of that development is substitution moderately than true growth. On the similar time, the increase in excessive‑perform wellness drinks – from probiotics to plant‑primarily based vitamin – is being outlined by specialist manufacturers, leaving Coca‑Cola with out the identical authority or credibility in these quick‑transferring segments.

With out sharper innovation, strategic partnerships or focused acquisitions, the corporate dangers being outpaced within the very classes driving the subsequent wave of beverage development.

These strategic uncertainties lengthen to Coca‑Cola’s place in sizzling drinks. If the Costa sale fails to progress, the corporate may as soon as once more discover itself questioning the position of capital‑heavy, retail‑led codecs in its lengthy‑time period development technique. Costa provided diversification past chilly drinks, nevertheless it additionally introduced operational complexity that sits uncomfortably alongside Coca‑Cola’s sometimes asset‑gentle mannequin. A stalled or deserted transaction could in the end push the enterprise to double down on scalable, decrease‑threat alternatives – notably prepared‑to‑drink espresso and partnership‑pushed beverage platforms — moderately than proudly owning and working bodily retail footprints.

Coca‑Cola’s subsequent chapter

As Coca‑Cola heads into 2026, the corporate strikes ahead from a 12 months of recalibration with a clearer view of each its alternatives and its constraints. The difficulties surrounding Costa and the shifting dynamics in wellness‑led classes have highlighted areas requiring extra centered execution, whereas robust retail efficiency and portfolio breadth proceed to underpin its resilience.

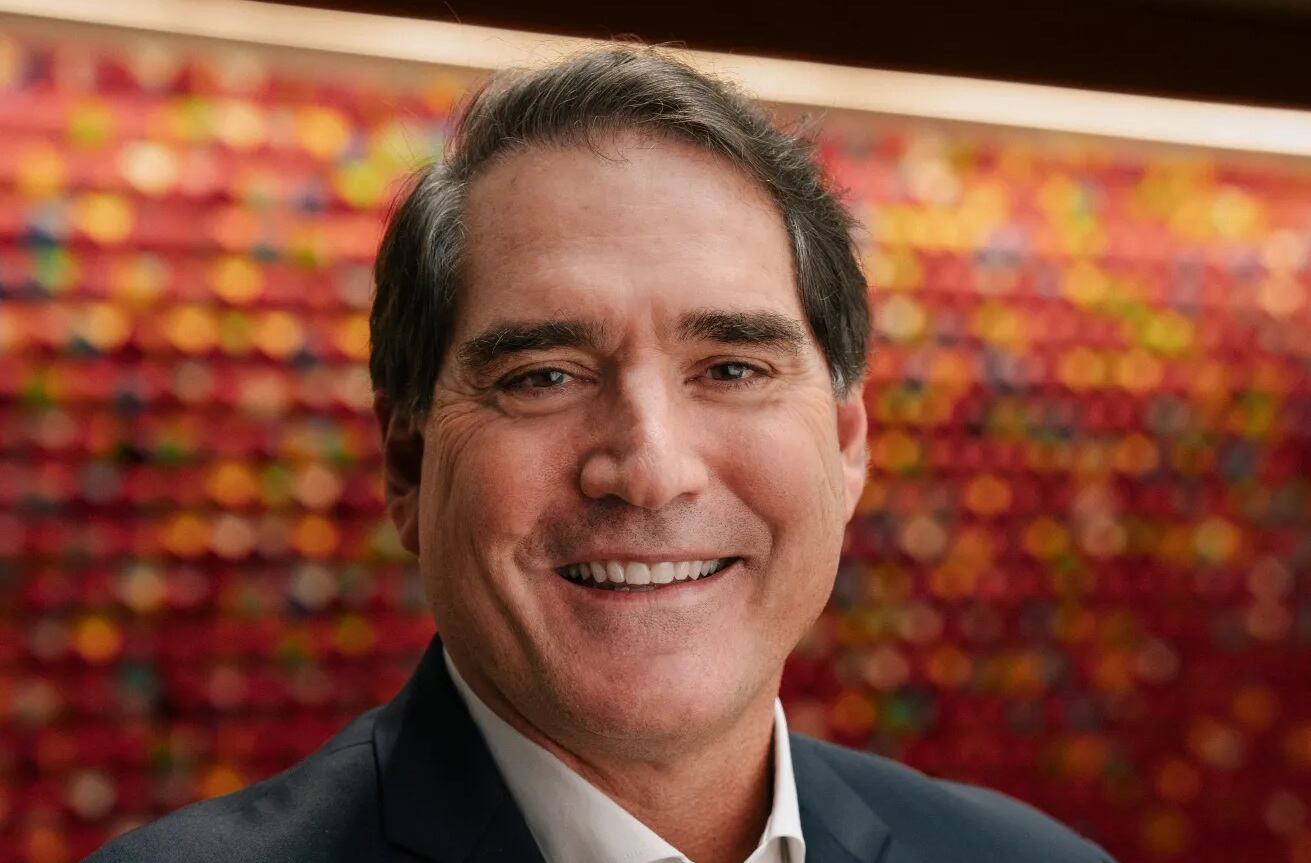

From 31 March 2026, Henrique Braun will take over as CEO, bringing almost three a long time of operational and worldwide expertise to the position, as James Quincey transitions to govt chairman. Braun has indicated he’ll focus on figuring out international development alternatives, strengthening client engagement and accelerating the corporate’s digital transformation efforts, priorities echoed by Coca‑Cola’s board and management staff.

With a refreshed management construction, ongoing funding in digital capabilities and a continued shift towards increased‑worth beverage segments, Coca‑Cola enters the brand new 12 months with a secure platform.

The months forward will take a look at how successfully the corporate can stability innovation with self-discipline, and the way Braun’s appointment shapes its method to development in a altering international beverage panorama.