The GLP-1 revolution reveals no indicators of slowing down. A capsule model of the appetite-suppressing drug, Wegovy, hit the cabinets of 70,000 U.S. pharmacies in January 2026.

In the identical month, UK-based retailers Morrisons, Asda, Co-op, and Iceland unveiled an assortment of nutritionally balanced ready-meals geared toward these with smaller appetites. Ocado Retail has jumped on the bandwagon, too, with a curated collection of GLP-1-friendly merchandise, together with a 100g extra-small steak.

However how sustainable are such choices? Is there progress potential past meal offers and prepared meals? And which manufacturers and companies are making the largest bets?

A current Cornell College report discovered the share of US households reporting no less than one GLP-1 person rose from round 11% in late 2023 to greater than 16% by mid-2024.

Additionally learn → GLP-1 disruption: Free webinar explores the newest in GLP-1

Morgan Stanley Analysis analysts estimate that 24m folks, or 7% of the US inhabitants, will likely be on the weight-loss medicine by 2035.

And in England, Wales and Scotland, 3.3m folks have expressed an curiosity in making an attempt weight-loss medicine over the following yr, based on UCL researchers, in comparison with 1.6m adults who used ‘skinny jabs’ between early 2024 and 2025.

“The UK and Europe could not attain the extent of the US, however even 2% to 4% penetration in key grownup demographics would drive substantial class change,” says Patrick Younger, managing director of PRS IN VIVO, a worldwide market and behavioural science analysis consultancy.

“In markets like Germany, France, and the Nordics, the place each weight problems and proactive well being traits are excessive, there may be sturdy potential for focused NPD and retailer-led innovation.”

Nestlé’s Very important Pursuit, a portion-controlled, nutrient-filled frozen meals line spanning pizzas and sandwich melts to wholegrain bowls, launched in 2024 to help GLP-1 customers in the USA.

Final yr, Danone unveiled a high-protein drinkable yoghurt for the US market underneath its Oikos label, which is claimed to assist customers construct and retain muscle mass throughout weight reduction.

Now manufacturers and companies within the UK – tipped to be the following greatest GLP-1 market – are following go well with.

A flurry of NPD – largely within the type of mini prepared meals – has hit cabinets prior to now month alone.

What’s on the UK’s GLP-1 prepared meal shelf?

Co-op: Good FuelAimed at individuals who use weight-loss jabs or have smaller appetites, the GLP-1-friendly mini meals are offered in 250g codecs and include protein, fibre, and one five-a-day portion. They’re accessible in Butternut Squash, Beans and Grains, Hen & Candy Potato Penang Curry, Hen & Courgette Alfredo Pasta and Butternut Squash, Beans & Grains (rsp:£3.50 every) choices

M&S: Nutrient DenseDeveloped by M&S cooks and nutritionists in session with the British Diet Basis, the 20-strong line-up includes salads, snacks, and meals designed to assist clients meet their RDA for fibre, nutritional vitamins, and minerals. Every product is claimed to include no less than one in every of 10 micronutrients, similar to vitamin D, iron, folate and vitamin B12, which, based on the retailer, many individuals lack of their weight loss program. Choices embody a Tandoori Hen (rsp:£7/400g), and a 35 Plant Salad bowl (rsp:£5.75/280g)

Morrisons: Utilized Diet Morrisons has partnered with Utilized Diet to launch Small & Balanced, a seven-strong GPL-1-friendly prepared meal vary designed for smaller appetites. The ‘comforting traditional’ dishes are mentioned to ship a balanced macronutrient profile. They embody Candy Potato Cottage Pie (280g), Spaghetti & Meatballs (250g), Candy Chilli King Prawn Noodles (280g), and Hen Casserole (280g) (rsp: £3.75)

Asda: Energy Pots Asda claims its excessive Protein Energy Pot vary is geared towards those that wish to give attention to well being with out the prep, or these with diminished appetites. Every 250g dish incorporates one five-a day portion, and 80g of fruit or greens. Meals embody Creamy Hen Korma, Thai Inexperienced Hen Curry, Hen Chow Mein and Hen & Mediterranean Type Vegetable Pasta flavours. (rsp: £2.50/250g)

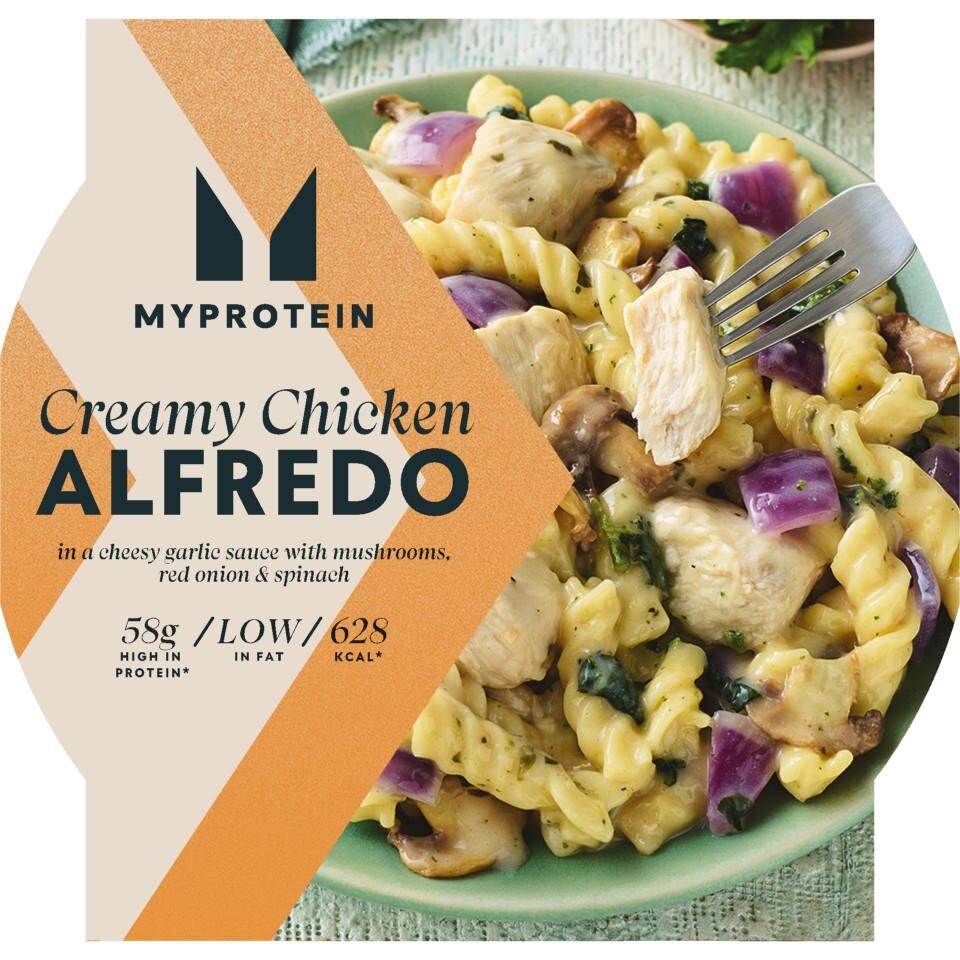

Iceland (Myprotein & Slimming World): The grocery store has launched 38 new meals for these utilizing appetite-suppressing jabs. The rollout consists of the largest ever enlargement of its Myprotein frozen vary and consists of prepared meals, breakfast omelettes, protein-rich sides and ice lotions, whereas the Slimming World Free Meals vary has enlarged to accommodate breakfast pancakes, on-the-go lunch bowls, crammed pastas, principal meals, sides and protein-packed meats, with first-ever additions similar to ravioli and naan breads

Ocado Retail: Ocado unveiled a GLP-1-friendly procuring aisle on the again of analysis, which discovered a information ‘vitamin hole’ amongst customers. Regardless of their essential position in preserving lean muscle mass and supporting long-term metabolic and digestive well being, solely 46% of two,000 folks polled recognized protein as a necessary macronutrient, whereas simply 48% deemed fibre as important.

The curated aisle options high-protein meals underneath 600 energy. Choices embody Turf and Clover Small Further Lean Steak 100g, (rsp: £3.50) M&S Nutrient Dense Romesco Hen, (rsp: £7/400g) Press Hen Teriyaki and Press Turkey Lentil Bolognese (rsp: £6.20/200g)

But, Younger believes there may be ‘vital headroom’ past the present meal deal and ready-meal focus.

“As GLP-1 adoption will increase, we’ll probably see progress in snack codecs, useful drinks, and ‘portion good’ indulgence merchandise. Suppose ice lotions, bars, and bakery gadgets reformulated with satiety in thoughts, decrease sugar, larger protein or fibre, and good portioning.

“There may be additionally a chance in meal parts like sauces, grains, and sides that assist folks self-assemble smaller, satisfying meals.”

Leigh O’Donnell, head of purchaser and class insights at Kantar, agrees that there’s appreciable progress potential.

“In accordance with our newest knowledge, 44% of UK customers have a brand new go-to retailer for groceries and family necessities,” she says. “It is because they need retailers that can assist them discover wholesome gadgets to help them on their GLP-1 journey.

“Customers additionally care about what they purchase. Some 23% need nutritionally dense merchandise, 21% need a greater variety of wholesome gadgets, and 21% need a product providing that can go well with particular dietary wants (like excessive protein, vegan, low energy).”

Amir Mousavi, meals advisor and founding father of Good Meals Studio, says the core difficulty isn’t about folks consuming higher, however folks consuming much less.

“The industrial problem then turns into the best way to keep income when quantity declines,” he says.

“Premiumisation, useful positioning and portion structure turn into the instruments of alternative.

“So we’re prone to see extra small, high-protein snacks, useful drinks positioned round tolerance or metabolic help, and modular meal parts reasonably than conventional plates.

“The true progress alternative sits past meals, in any class the place manufacturers can extract worth from fewer consuming events. That features snacks, drinks, dietary supplements and hybrid codecs designed to ship “extra vitamin per chew”.

Notably, the drug’s uptake is impacting family spending.

Inside six months of beginning a GLP-1 medicine, US households diminished their grocery spend by a mean of 5.3%, Cornell College’s research discovered.

Amongst higher-income properties, the drop was even steeper at greater than 8%.

Extremely-processed, calorie-dense meals noticed the sharpest declines, spending on savoury snacks fell by about 10%, and sweets, baked items and cookies skilled equally massive decreases.

Nonetheless, gross sales of yoghurt, recent fruit, vitamin bars, and meat snacks elevated, the analysis confirmed.

Younger believes the behavioural and cultural shifts GLP-1s are triggering are prone to outlast the medicine themselves. “Urge for food suppression at scale adjustments meals routines, grocery habits, and even social consuming norms,” he says.

“So even when the class plateaus or regulatory issues develop, the demand for less-but-better consuming and portion-savvy merchandise will persist. Manufacturers that deal with this as a broader wellbeing motion, reasonably than a slim weight loss program pattern, will likely be finest positioned to adapt. The bubble could shift in type, however the urge for food for smarter, lighter, extra satisfying meals will endure.”

Additionally learn → GLP-1 disruption? Uncover what’s subsequent in free webinar

Rafael Rozenson, founding father of protein water model Vieve says that fifty% of its clients have been utilizing its drinks primarily for weight reduction functions, “lengthy earlier than GLP-1 drugs entered the mainstream dialog”.

Nonetheless, the model has recognised that its merchandise could now enchantment to GLP-1 customers, who sometimes “over-index” attributable to their want for smaller, nutrient-dense parts and protein and fibre necessities.

In January, Vieve entered the snacking sector with a trio of useful protein bars – Pistachio Punch, Strawberry Blondie and Coconut Crunch, which include 15g of protein, 12g of fibre, no added sugar and fewer than 160 energy per bar.

In accordance with Rozenson, the vary has already offered out of its first manufacturing run and has “sturdy curiosity throughout all key accounts plus worldwide markets”.

Mousavi want to see the broader meals business lean into dietary fibre as a manner of supporting the physique’s personal GLP-1 manufacturing and marketplace for this accordingly.

“The problem is that this route is structurally laborious to monetise,” he says.

“Excessive-fibre, minimally processed meals are usually decrease margin, more durable to model, and fewer appropriate with premiumisation. Additionally they work slowly and cumulatively, which doesn’t map neatly onto the product claims or quick gratification customers have been skilled to anticipate.”

Mousavi provides that the meals business is unlikely to begin competing in opposition to Massive Pharma on the place customers’ GLP-1 ought to come from anytime quickly.

“As a substitute, we’re extra prone to see fibre integrated into reformulated, branded merchandise the place it may be measured, marketed and priced, reasonably than a significant shift in direction of easier, fibre-rich diets.”

Rising analysis means that GLP-1s might not be the ceaselessly ‘surprise drug’ to assist customers reduce weight completely, whereas experiences of undesirable unwanted side effects ceaselessly hit the headlines.

May shopper urge for food for the drug dampen on the again of this?

O’Donnell doesn’t suppose so.

“GLP-1s aren’t going anyplace,” she says. “The medicine may now be taken in capsule type, which makes it simpler for the person and cheaper to fabricate and transport than refrigerated jabs. The Ozempic patent is because of expire in a number of international locations this yr, which can additional enhance accessibility and affordability.

“There may be additionally different early analysis that reveals that GLP-1 might be an efficient remedy for drug or alcohol dependancy, so we are going to probably see the medicine be used past diabetes and weight problems sooner or later.”

Additionally learn → Get forward on GLP-1 with a free webinar